Icici Bank Account Closing Form

- Products

- High Interest Investment Savings Account

- Term Deposits

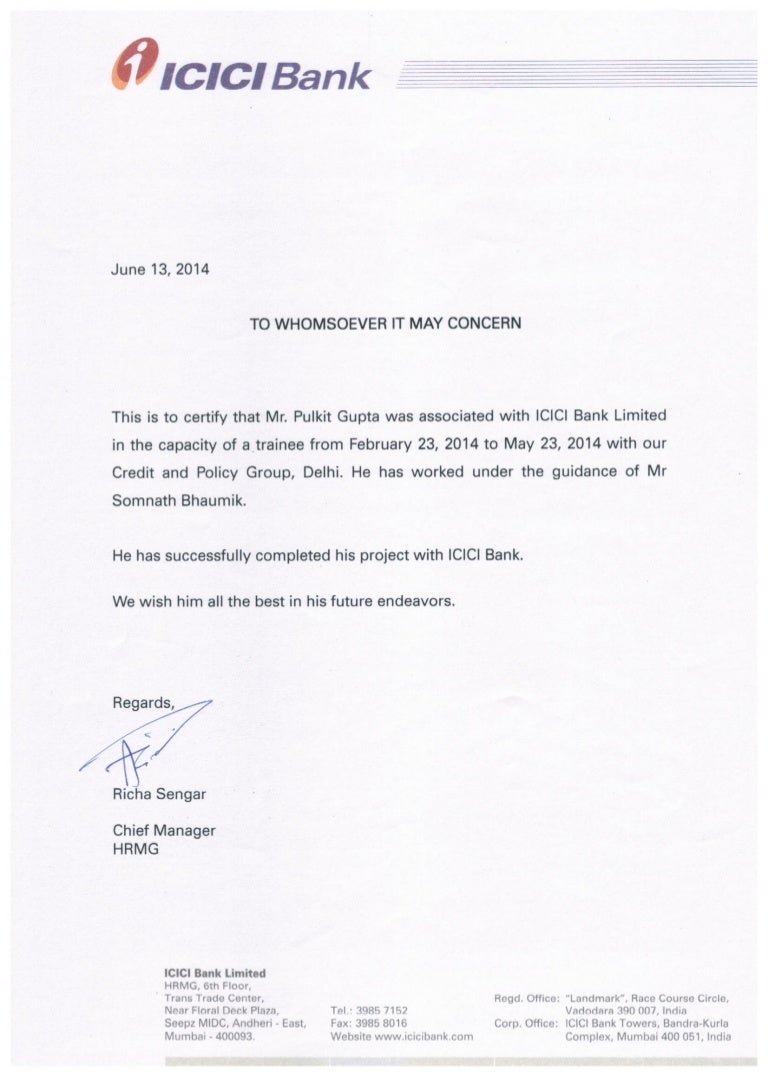

ICICI Bank has fixed deposit accounts with attractive interest rates and flexible repayment tenures that range from 7 days to 10 years. Opening or closing an FD account with ICICI Bank is easy and hassle-free. Ways to close an ICICI FD Account. You can close your ICICI FD account in three ways: Online on the official website of ICICI. In order to close your bank account, the first step is to fill up an Account Closure Form. You can download it from bank's website or alternatively, you can visit your branch, get the account closure form and fill it up properly. After that you need to sign it and submit it to the branch manager/ officer-in-charge. Please note that if there is/ are any joint holder/s in your account, all need to sign the account closure.

- Other Segments

- Other ICICI Bank Website

- ICICI Bank Country Websites

After the account has been opened, when will we receive the Term Deposit / RSP / GIC confirmations?

Fifteen business days is the standard time. However, ICICI Bank Canada reserves the right to extend this depending upon market and business factors.

Is a Term Deposit the same as a GIC?

Yes it is. ICICI Bank Canada has registered the name Term Deposit for our GIC product with CDIC.

With regard to joint ownership GICs, are they registered as 'or', 'and/or', or 'and'?

Does ICICI Bank issue a certificate for a joint investment as 'and' upon a client's request?

No. ICICI Bank Canada opens all joint accounts as “and/or” only.

How closely must the pre-printed names on the client’s personal cheque match the investment registration?

The name should be the same as the account holder’s name. We will contact you for clarification if there is any discrepancy.

Does a Joint bank account cheque signed by both act as Identification for both owners on a GIC application?

Yes. A Joint bank account cheque signed by both acts as Identification for both owners on a GIC application.

What value date is given for a non-registered GIC or savings account?

Either a) date of postage of cheque, marked on the envelope or b) if deposit made by EFT, date of credit in account or c) date of credit in NDDS account with RBC. Note that a photocopy of the stamped deposit slip must be sent to us along with the name of the client.

How many days in advance will ICICI Bank forward the maturity cheques to our office and will ICICI Bank use a courier service for the same?

Cheques will be provided 2 weeks prior to maturity date. Our courier service provider is ICS.

How will the Bank send out transfer cheques to other institutions?

ICICI Bank will send out transfers through our contracted courier service, ICS.

Do we need to request the maturity cheques or will ICICI Bank forward them to us automatically?

The maturity cheques shall be sent to the Financial Representative, for clients sourced by them, unless the client explicitly mentions not to send the maturity cheques to the Financial Representative.

Will ICICI Bank require their certificates/confirmations back at maturity for redemption?

Only if a client walks into a branch to withdraw the deposit.

How will the Bank handle an investment that matures on a weekend or holiday?

ICICI Bank will automatically roll over the maturity date to the next business day.

Do we need to retain client information at our office?

Yes. A record of all client information needs to be maintained by the FR at their office. The information includes:

Icici Bank Account Closing Form

| What you need to retain at your office | |

|---|---|

| Please retain a copy of 2 pieces of identification (ID) for each individual (Photocopied front & back to clearly identify the individual’s signature), ensuring that at least one piece is from List A below: | |

Primary Identification (List A) | Secondary Identification (List B) |

|

|

If you want to close your ICICI bank account then make sure that you have withdrawn all your balance amount from your bank account. Next you need to visit your ICICI branch and there you can get an account closure form of ICICI bank. Sometimes the bank staff may ask you to write a letter to close your bank account.

In that case, you can use the below format to close your bank account in ICICI bank, not only for ICICI you can use this format for any other bank account closing.

Icici Bank Account Closure Form Pdf

ICICI Bank Salary Account Closing Letter Format

To

The Branch Manager,

ICICI Bank,

Address.

Sub: Request to close bank account

Dear Sir,

I, Mr Raghuram Chappa, have a salary account in your bank with a/c no 456789123. Recently I have changed my job and got a new bank account with some other bank.

Hence my salary is not crediting into this account, my account has converted to a normal account and charges are deducting from my account for not maintaining the minimum balance.

Hence I decided to close my account, so please close my bank account in ICICI bank associated with a/c number 456789123.

Please do the needful.

Thanking you.

Regards,

_________.

ICICI Bank Account Closure Letter Format When Relocating

To

The Branch Manager,

ICICI Bank,

Address.

Sub: Request to close bank account

Dear Sir,

I, Ms Anuradha Uppalapati, have a bank account in ICICI bank, II town branch, Vizag with account number 456789123.

Due to my job transfer we are moving to a new place where I don’t hae a chance to avail the services of ICICI bank.

So here I am requesting you to please close my account with a/c no 456789123.

Please do the needful.

Thanking you.

Regards,

_________.

When to Close ICICI Bank Account

- When you have a salary account and moved to a new job, and if your salary is not crediting in the ICICI bank account then you can close it. ( Because salary accounts have Zero minimum balance facility). Otherwise, your account will be converted to a normal account and charges will be levied if you don’t maintain a minimum balance.

- When you are relocating to a new place then you can transfer your bank account to the new ICICI branch or you can close your existing ICICI bank account.

ICICI Bank Minimum Balance Rules

FAQs on Closing ICICI Bank Account

Should I need to return my debit card, and unused cheques to the bank.

It is better to return them when you are closing the bank account. In case if you lost them or not carrying with you then you need to write a letter that the bank is not responsible for any future claims related to your unreturned cheque leaflets.

Should I need to close Credit card Separately.

Yes, you need to close your credit card separately. You can do that by calling ICICI bank customer care number ✆ 1860 120 7777. Read this to know the complete process of closing the ICICI credit card.

Also read: